Hello and welcome back to our annual statistics series! . . . Or as I am tempted to call it “the blog post I keep trying to write but am always interrupted before I can finish!” Ordinarily, I break this discussion into two separate posts, one for the band sizes and one for the cup sizes. However, this year, in the interest of changing things up and including other elements into the statistical analysis, I have combined them into a unified post. Knowing which band and cup sizes generally sell best aids in selecting the overall range to focus new inventory (such as 30-40 DD-G), but analyzing the actual best-selling bra sizes assists in fine tuning that selection as well as knowing what sizes deserve multiples. So let’s get to it!

Band Size Observations & Notes:

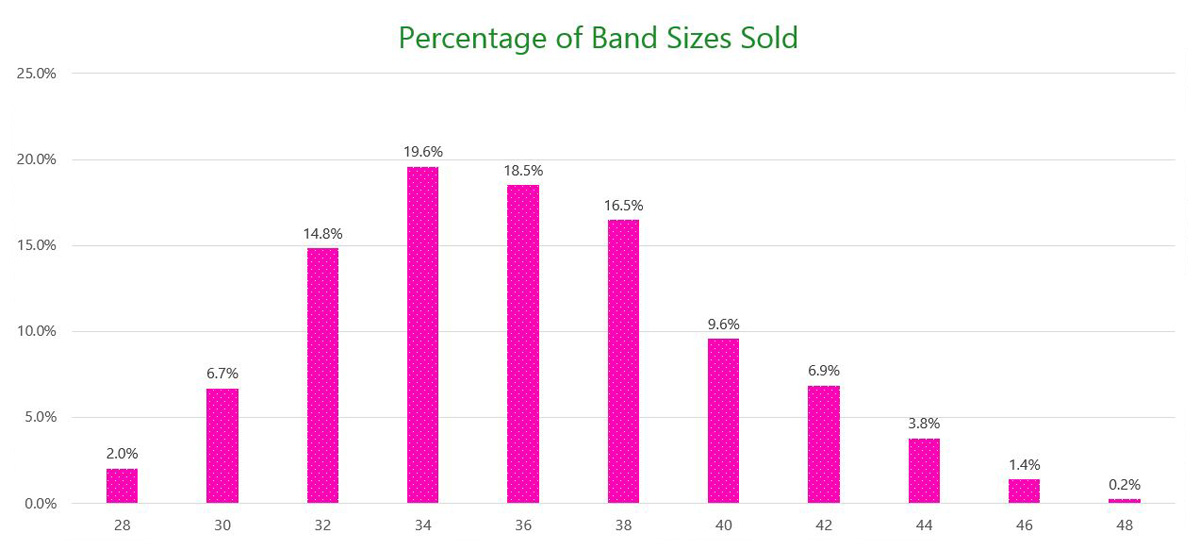

- We have sold a few 26 bands, but the frequency is so sporadic and the amount so trivial that I have not included them in the graph. Similarly, I included 50+ bands last year in our statistics but decided to omit them this year. Many of those figures are represented by the same core customers, and the distribution was not strong. As a result, the chart technically represents the percentage of band size sales among 28-48 bands only with another 0.03% of total bra sales occupied by the 26 bands and the 50-56 bands.

- Band sizes 32 to 38 account for nearly 70% of our total sales, which is identical to last year. If we factor in 40 bands, the figure jumps to nearly 79%, also the same as last year.

- The 34 band size continues to be our best-selling band size store-wide, accounting for nearly 20% of our sales.

- 28 and 30 bands only account for 8.7% of our sales which is down slightly from last year.

- Traditional plus-size bands (38-46) represent 38.4% of our sales, up from last year.

Cup Size Distribution Observations & Notes:

- Cup sizes UK E through G account for roughly 55% of our sales, down 4% from last year, and if we include D and DD cups, the number jumps to 69.7%, also down from last year.

- The GG+ cup sizes account for over 26.2% of our sales, up 2% from last year.

- Traditional mainstream cup sizes A-DDD/E account for nearly 33.7% of our total sales, up almost 3% from last year.

Before I expand on my analysis, I want to remind everyone that these charts are based on five years of cumulative sales, meaning there is no way to distinguish recent areas of growth or decline for some sizes. However, areas which boast significant increases like A-DDD cups or plus-size bands are driven almost entirely by sales in the 12 months prior. Because of the cumulative nature of the series, certain sizes are padded by prior sales rather than recent ones, and I want to write a separate post elaborating on these areas of growth and decline further.

The Line in the Sand: 28 vs. 30 Bands

Every year, I specifically mention 28 and 30 bands in the same context, and I debated whether or not I wanted to rehash the discussion this year. Ultimately, after pouring through the data as well as taking into account my personal experiences as a fitter in the store, I realized the disservice I was giving to 30 bands. In reality, 28 and 30 bands should not necessarily be lumped together in the same category. Yes, yes, I know they are adjacent to each other and are separated by a mere 2″, but the subtle difference lies in sales performance. Our sales figures for 30 bands are completely acceptable for me and have experienced general growth and a better turnover rate in the last 12 months. We have expanded inventory to incorporate new brands and more styles, and our customers are responding positively, mostly purchasing at full price and ordering multiple colors. After all, 30 bands perform better than everything outside of the core 32-40 spectrum. The 28 bands, however, continue to flail in the water. Comexim special orders and the Freya Deco are the sole life preservers keeping the band size afloat, and outside of this boost, the 28 band size consistently sells on sale rather than full price. The average 28 band bra retails for $60ish market-wide, but in the shop, the average exit cost is $43 (roughly 70% of estimated retail which drops my profit margin to a paltry 37% at best). It’s a size that we constantly stock for size inclusivity but whose sales figures do not support or justify a large or diverse selection. In fact, a few well chosen basics plus Comexim is the direction we’re heading.

For a long time, I was constantly ordering fashion or ensuring we included the size when available as part of a new style—a motivation driven in large part because I felt I needed 28 bands to be truly representative of our customers. Many feel a specialty shop should obviously carry a large selection in this band, but sales figures paint a rather bleak picture for us. It doesn’t help that these customers are often either the least satisfied with inventory or the most likely to wait for sales. People who wear 50 bands or 48 or even 46 tend to understand that stores may not carry that size, even a specialty one, and are usually okay with ordering. Comparatively, more of the 46 bands (1.4% of sales) sold at full price than the 28 bands (2% of sales), making 46 bands a sounder financial investment despite a lower dollar amount in total sales. From speaking with other retailers, manufacturers, and bloggers around the globe, 28 bands seem to be a vocal subset but one not strongly represented for actual sales. I appreciate their passion and commitment, but unfortunately, it’s just not a group that visits the shop frequently or pays full price when they do. One of my goals for this year has to been to make the shop more sustainable for the future (a topic I will discuss in another post), and I plan on making adjustments to what we offer in store to better capture the needs of the market without carrying excess inventory.

To play devil’s advocate, a counter-argument raised to my statistics on 28 bands posits that if my inventory were more representative of what the customer wants, that sales would naturally increase. It’s not a point without merit, particularly because there are often scaling and fit issues in 28 bands which make it challenging to select the best products. A smaller rib cage, regardless of cup size, will need special considerations, but the more time spent on design or on materials to address problems will also increase price. We have a pretty generous special order policy as a shop for trying new styles and presently offer multiple models in that band size from brands like Panache, Freya, Little Bra Company, Comexim, and Skarlett Blue. I think the greater issue is that most people who would traditionally wear the 28 band do not like the tightness and opt for 30 or 32 (thus decreasing overall sales figures for the band), and those who do prefer 28 are looking to spend less than $50 at most. If I am being completely honest, fives years of sales figures indicates the demand for the band is greatly overstated, and looking back through recent transactions, the last in-store 28 band purchase was over two weeks ago and was a special order pick-up. It’s been at least 30 days since I had a walk-in sale for a 28 band.

Plus-Size Bands on the Rise

On the flip side, plus-size bands (38-46) have shown an increase in sales, particularly in FF+ cups. There were a few months earlier this year where I was barely able to keep 42-46 GG-J cups in stock, and there was a particular Saturday which comes to mind where we had three separate women wearing a UK 46H come in needing bras (the last of which unfortunately had to order as we were completely sold out). In general, I think we have seen not only more word of mouth referrals from this band size range but also from big box retailers like Catherine’s and Lane Bryant who typically stop at the US H cup and are seeing clients needing something substantially larger. This band size range is also an area where I have seen some ladies who are simply outside the standard cup sizes produced by most manufacturers, and we have been issuing referrals to Ewa Michalak. One of my goals for the next 12 months is to stock her K-LL cups in the shop to address the demand.

The Dilution of the Cup Size Concentration

Our original purpose of being a fuller-bust store is well-documented in this statistical series, and for the first couple years, we primarily saw the highest sales in UK E-G cups. As we have been open longer, we transitioned to being more encompassing of different sizes, especially A-C cups, and the resulting sales have essentially stretched the distribution to create a Bell curve. Sales for E-G cups have been declining while sales for A-C have been rising fast. In fact, I noted we were down in D-G, but A-C was up. Sales in higher cup sizes also increased, meaning the sales represented by the traditional D-G core declined simply because we saw an uptick in sizes on either side, namely A-C cups or GG+. For giggles, I went back to our first two statistics series, and at that time, we really did not have a true Bell curve but rather what I referred to as “steps” in which cup sizes performed best. The cup size curve for this year is what I predict to be relatively consistent for the shop in the future too. The numbers may change slightly (and in fact I do think we’ll see more growth in A-C cups in particular), but the shape for each of the sizes is most likely fully developed. A-C cups were an area I honestly never expected to see much sales from because we are so close to Victoria’s Secret (the industry leader) as well as department stores like Kohl’s, Belk’s, Dillard’s, and JC Penney. It’s one of the reasons I focused our initial inventory so fiercely on hard to find sizes like DD+ as I thought we’d be most likely to find a niche with clients who are desperate and unable to find their size elsewhere (like I was for many years). My rationale was similar with plus-sizes as I fully expected A Sophisticated Pair to focus on 28-40 bands and D-K cup sizes. Little did I realize that there were many people in A-C cups who were unhappy either with the selection or models offered by competing retailers or who felt like they did not have a positive shopping experience. As the demands slowly filtered in for more sizes outside that range, we have expanded accordingly by carrying more A-C cups from brands like Natori, Skarlett Blue, b.tempt’d, Wacoal, and Affinitas. We also recently started carrying the Little Bra company, specifically for this customer. Now if only we could find some great bras for the 38+ bands and AA-C cups we’d really be set!

Bonus Stats! Knickers!

Underwear is an area that we have steadily been branching into more, again mostly because of customer demand. When we first opened, our budget was stretched so thin we squeaked by with Natori bliss panties and the occasional coordinating set. As the shop grew, we began investing in what are called “pant programs,” typically demarcated by a buy more discount, such as “$18, 3 for $45.” Natori, Wacoal, and b.tempt’d all offer this in multiple styles, but we also still bring in matching underwear for some fashion bras. In terms of sizing, medium and large reign supreme. The size small gets the most boost from the pant programs as I often no longer carry matching bottoms in that size anymore. Medium and Large are first out the door with X-Large not far behind. One of the areas we hope to grow as a business is in offering a lot more underwear brands and styles as they really deserve a second shopping trip outside of bras, and we are currently looking at quite a few options for more classic styles like full briefs in addition to cute, affordable plus-sizes.

What did you think of this year’s results? Were there any surprises? For the retailers reading this blog, I’d love to hear if our sales collaborate with yours or if you find you serve a totally different demographic.

Erica

P.S. Other blogs in this year’s series: A Guide to Interpretation.

P.P.S. Links to Year 4 Stats: Demographics, Band Sizes, Cup Sizes, Bra Sizes, and Best-Sellers.

Leave a Reply